Discover how Arkon Energy secured $110M for data center expansion and AI cloud services. Learn about their strategic growth plans, investors, and vision for the future.

Contents

- 1 Introduction: Arkon Energy’s $110M Fundraising

- 2 Arkon Energy: Growth Journey

- 3 The Funding Round Details

- 4 Arkon’s Expansion Plans

- 5 Business Model: Distressed Data Center Assets

- 6 Diversification into AI Cloud Services

- 7 Meeting the AI Industry’s Infrastructure Needs

- 8 Arkon’s Vision and Market Predictions

- 9 Conclusion

Introduction: Arkon Energy’s $110M Fundraising

Arkon Energy, a pioneering data center infrastructure company, has successfully concluded a substantial private funding round, securing an impressive $110 million. This monumental achievement, as revealed by the company’s CEO Josh Payne to TechCrunch, marks a significant milestone in the company’s evolution.

Arkon Energy: Growth Journey

Establishment and Growth

Founded in 2021, Arkon Energy embarked on its journey with a modest 5-megawatt site in Australia. However, within a remarkably short span, it has burgeoned to encompass over 130 megawatts and has strategically expanded its operations beyond Australia, venturing into prominent regions like the U.S. and Europe.

Expanding Operations

The company’s appeal extends to both bitcoin miners and clients in the AI and machine learning domain, catering to their immensely high-power computing demands.

The Funding Round Details

Arkon’s fundraising round, spearheaded by Bluesky Capital Management and complemented by the participation of Kestrel 0x1 and Nural Capital, substantiates the confidence and interest that prominent investment entities hold in the company’s vision and potential.

Key Investors

Bluesky Capital Management emerged as the primary driving force behind this significant funding initiative, joined by notable contributors Kestrel 0x1 and Nural Capital.

Allocation of Funds

A substantial portion, approximately $80 million, is slated for acquiring an additional 200-megawatt capacity across new data centers in Ohio, North Carolina, and Texas. This strategic move aligns with Arkon’s ambitious plan to amplify its total megawatt capacity by an astonishing 130% by mid-2024.

Arkon’s Expansion Plans

Increasing Data Center Capacities

Arkon’s strategic focus involves bolstering its presence and influence within the U.S. market. This involves acquiring distressed data center assets, a strategy that has proven effective for the company, especially with its recent acquisition of a 100-megawatt facility in Ohio.

Focus on the U.S. Market

The company’s attraction to the U.S. market stems from various factors, including robust energy industries, regulatory stability, and burgeoning customer demand.

Business Model: Distressed Data Center Assets

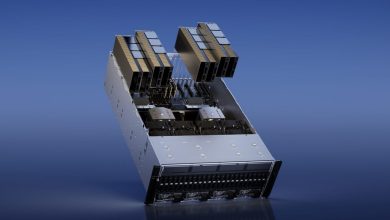

Arkon’s business model revolves around acquiring distressed data center assets globally, catering to the escalating demand for various types of data center capacities, professionally managed and operated to meet the needs of energy-intensive platforms.

Diversification into AI Cloud Services

Arkon’s forward-looking approach includes allocating $30 million toward developing an artificial intelligence cloud service project at its data center in Norway. This strategic move aims to cater to the burgeoning demands in generative AI and large language model training markets.

Meeting the AI Industry’s Infrastructure Needs

With a surge in AI applications and the potential growth of Bitcoin in mainstream institutional markets, Arkon aims to bridge the infrastructure gap required to power these cutting-edge technologies.

Arkon’s Vision and Market Predictions

Josh Payne highlights the company’s vision of scaling exponentially, especially with the rising demand for AI applications and the potential approval of a spot ETF for Bitcoin, solidifying the need for specialized data center infrastructure.

Conclusion

Arkon Energy’s recent funding milestone and strategic allocation of resources underscore its commitment to innovation, meeting market demands, and poised growth within the data center and AI industries.